Why retirement isn’t a finish line, and the moments that matter instead

And my first column is out in The Times - read it here - 'The five secrets of the happiest pensioners'

In this weeks newsletter:

Feature: The new retirement milestones to celebrate

The Times: The five secrets of the happiest pensioners

From Bec’s Desk: 18 days to go

It’s Epic Retirement Month!

20 November to 20 December is Epic Retirement Month. It’s the month when the largest number of people retire across the western world, according to my own insights and data. And that’s worth supporting.

So we’re offering thirty days of inspiration, education and the kind of practical advice that helps you shape the second half of life on your own terms.

If you’d like to explore more, visit my new website: www.epicretirement.net

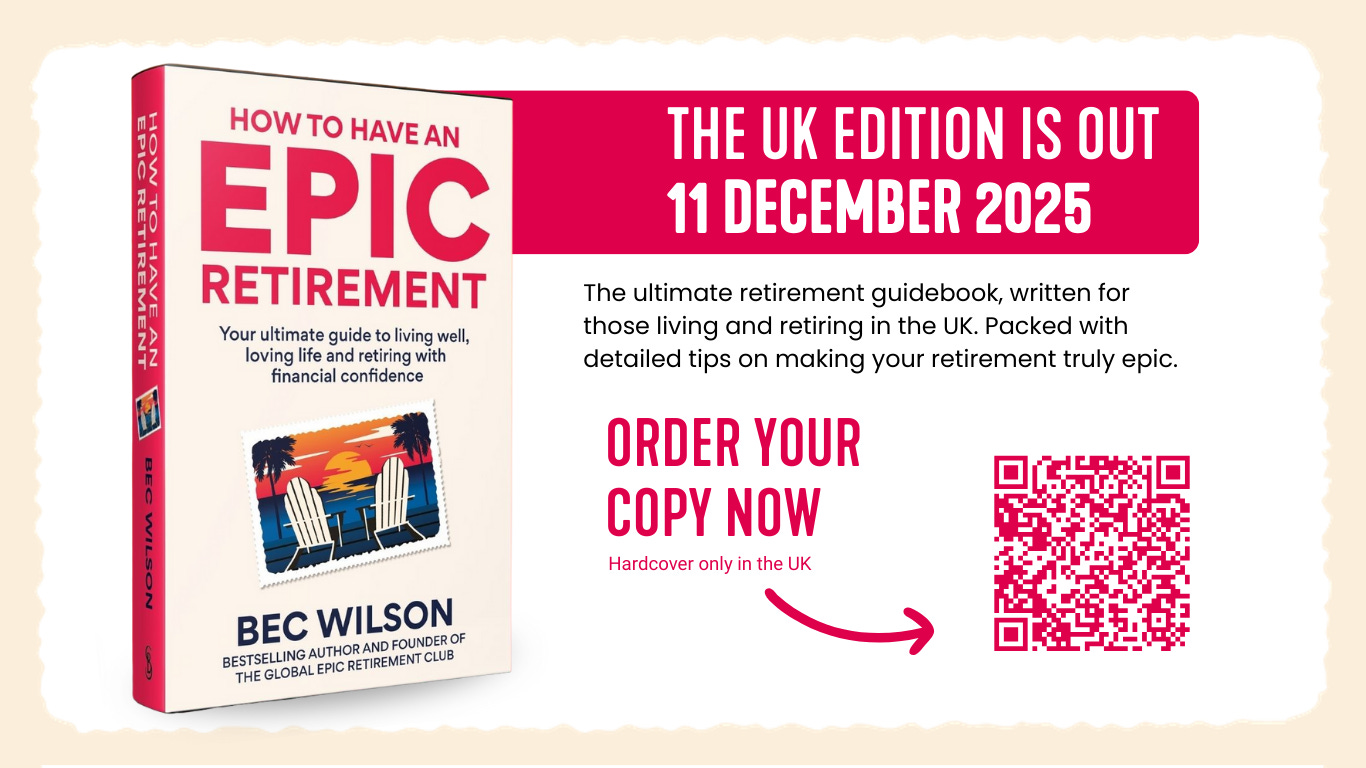

And in the month ahead comes one of the biggest moments of all: the launch of the completely new, UK edition of How to Have an Epic Retirement

And, over on my NEW website we’ve released The Epic Retirement Starter Kit - a free 16 page guide to help you navigate retirement - with a dedicated UK edition. It’s just for Epic Retirement Month. Go get it!

Retirement isn’t a finish line - the moments that matter instead

You’ll often hear me say that I don’t want you to think about retirement as a finish line anymore. That is the old way of retiring. And we now know that people who take a slower road into retirement, gradually stepping back from work that no longer fits and routines that no longer serve you, tend to have a smoother and healthier transition into the next stage of life than those who stop cold.

But I will admit something. When you take the gradual road, it does steal a bit of the romance from the ending you might have pictured. The day you walk in and tell your boss you are done. Then the big Hollywood-style last day of work with ballons, cake and tears of joy or sadness. There is no dramatic exit or champagne moment. The shift happens quietly and almost invisibly over time. And for some people, that means there is no single moment where your peers celebrate you, and your working years can feel like they slipped away quietly rather than with a bang.

So instead, I want you to think about the journey into retirement as a series of small, celebration-worthy milestones. Quiet, meaningful markers you can acknowledge and even celebrate privately with the people that matter. Because each one is a sign that you are moving into your next chapter with intention and a clearer sense of who you are becoming.

Here are a few you might recognise. And remember, you do not need to tick them all off and they certainly do not happen in any fixed order. Notice the ones that resonate and the ones still ahead.

The day you demolish all your debt

There is nothing quite like the day you make that final repayment. Whether it is the mortgage, a stubborn loan or the last bit of credit card debt you have been chipping away at, it always lands the same way. Quietly, privately and with a deep sense of relief. You close the laptop, lean back and your whole body feels lighter.

It is not just about the money. It is the shift in ownership. From this day on, every dollar of your future cashflow belongs to you, not the bank. For many people, this is the moment retirement stops feeling abstract and starts feeling possible.

The day you realise you will have enough to retire

Most people can point to the exact moment this one hits. You finally run the numbers properly, you look at what you have and what you need, and you can see the point on the horizon where everything lines up. You know your number and you know when you will reach it. You do not need to retire tomorrow, but from this point the fear drops away. You are in a position to choose yourself and that is a quietly powerful moment.

The day work starts feeling optional

This one feels different from burnout. You are still showing up and contributing, but your identity is no longer locked to your job in the same way. You realise you could step back if you wanted to. You can picture yourself working fewer days, changing your pace or taking a proper break. It is the first real sign that the power dynamic between you and your work has shifted.

The day you hand over a project and feel relieved, not sad

This often catches people by surprise. Someone else takes over something you have carried for years and instead of feeling protective or left out, you feel relieved. You are genuinely glad it is no longer yours to hold. It is one of the clearest signs that you are loosening your grip on full-time work.

The day you start imagining the shape of your weeks once you are done

Not in a grand, dramatic way. More in the everyday sense. You imagine slower mornings, having time for things you enjoy, not rushing through every day. You picture a week that feels more like yours. This is usually the moment when time starts to matter more than money.

The day you quietly trial your first version of retirement

Maybe you drop a day. Maybe you take long service leave. Maybe you simply stop operating at full tilt. You do not call it retirement, but it feels like a rehearsal for it.

This is how most people retire now. No big announcement. No farewell speech. Just small and intentional adjustments that gradually become your new rhythm of life.

The day you decide to get intentional about the next stage

This is the true turning point. You stop imagining retirement as something that will just happen one day and start shaping it on purpose. You want your time, your lifestyle and your pace to change, and you want it to happen on your terms.

This is the moment you begin understanding how the retirement systems work, where your income will come from and what decisions you need to make. Retirement stops being an ending and becomes something you design.

The day you tell someone you trust that you are retiring this year

It often happens in a small, private conversation. Over coffee, during a walk or at the kitchen table. You say it for the first time. “I am finishing up this year.”

It is not dramatic, just real. And the moment you say it, the transition begins.

The day you walk out for what you think is the last time

It rarely looks like a movie moment. Most people describe it as steady and calm. You finish what you need to finish, you say your goodbyes and you walk out the door.

If you have been in your career a long time, you might celebrate with a few close friends or colleagues - or head to the pub. Or you might skip the fuss entirely because you feel emotional or nervous. Either way, something shifts as you step away. You have moved from talking about retirement to living it.

The first weekday that feels entirely your own

This usually hits within the first couple of weeks. You go for a walk, make breakfast slowly or run errands without weekend crowds and it dawns on you. This is your time now.

It is one of the real joys of this stage of life, but also the moment you realise you need to use that time well.

The day you start shaping what you actually want from this next stage

This is when retirement starts feeling like something you are building rather than something you ended up in. You begin thinking about how you want your weeks to feel, how you want to use your energy and what you want more of or less of.

You have seen how quickly free days disappear if you are not intentional, and now you want them to disappear in the right direction. It is a gr

The day you leave on your first big trip after retirement

For a lot of people, this is one of the most joyful and emotional milestones. You finally have the freedom to travel when everyone else is back at work, and there is something delicious about that. It might be a long-haul adventure you have talked about for years or just a few weeks somewhere warm, but the moment you click “book” and the day you take off feels different now.

You are not squeezing it into annual leave or racing back for Monday meetings. You can choose shoulder season instead of peak season. You can stay longer. You can take your time.

It is often the first moment when retirement feels expansive rather than uncertain. You realise you now get to decide how you want to spend your days, your seasons and your energy. And that simple act of booking a trip becomes a quiet celebration of everything you have worked for. It is one of the loveliest “this is my life now” moments you will experience.ounding moment and one of the most important parts of the transition.

Tell me today the days that you’re looking forward to and how your retirement will shape. This is different for everyone.

Have you visited the Epic Retirement Shop?

Epic Retirement Varsity-Style T-shirts & Mugs

Retiring can very much feel like a milestone event, a bit like school seniors feel when they’re graduating from school. There’s loads of build up,

So, we’ve curated a range of fun varsity-style t-shirts and mugs you can buy for yourself or gift to someone. They’re print on demand - so once you place your order they’ll take 6-10 days to arrive. If you want them for Christmas or the retirement season prior to, you’ll want to get your order in now.

The five secrets of the happiest pensioners

This article, my new regular column, appeared in print and digital in The Times new Consumer Money section on Saturday 22nd November.

It’s not enough just to retire in this day and age — expectations of retirement are much higher than that. UK life expectancy now means that one in four 65-year-old men will live to 92 while one in four women will live to be 94. The goal isn’t simply to retire comfortably; we’re under more pressure than ever to retire happily.

Let’s face it, retirement is one of the most complex financial challenges of our time. We plan for it thinking that it’s about money and stopping work. But it’s so much more. It’s about using what you have, to build a life powered by passive income — one that brings you purpose and joy for 25 to 35 years, step by step.

After years of talking with hundreds of people who have managed to get this stage of life right, along with plenty who haven’t, I’ve come to see a clear pattern. People often ask me for the secrets of the happiest people in retirement — and I can boil it down to five valuable lessons.

Do the financial groundwork

The happiest pensioners I see have financial sensibility and excellent money habits. They saved consciously for retirement, paid off their mortgage and moved out of the rat race with a plan, usually on a timeline that they have been able to shape. They built multiple income streams, from pensions to Isas, dividends or part-time work, and they understand how those pieces fit together.

They are financially literate and engaged with what they have and what it can do for them, not in a spreadsheet-obsessive way, but in a confident, capable one. They understand tax-efficient contributions, the value of compound investing, the importance of growth assets, and how to turn their money into an income that suits their retirement lifestyle goals.

Focus on cash flow, not pot size

Happy pensioners aren’t fixated on how big their savings pot or pots are; they are focused on how their money flows. They know when and where income arrives, how long it lasts, and what it can support. They understand how to minimise the tax on that income, and how to pull in their belt in a tough year.

This article is a full feature which continues in The Times - you can read it here.

The UK book release countdown begins - 18 days to go

I feel like I’ve been running on fumes for a few weeks, and this week it really hit me how close we are to the holidays. I almost sighed with relief. The audiobooks are finally put to bed, the new editions of How to Have an Epic Retirement for Australia and New Zealand are released this week, and then the full UK edition launches on 11 December — just 18 days to go.

It’s definitely late in the year to release a book, but we wanted it to land during Epic Retirement Month — the month when so many people step back from work and begin planning the next stage of their life. And we did it. But if you’d like a copy before the last posting dates for Christmas, it’s worth pre-ordering now.

As you’ve probably gathered, I’ve officially given the next 30 days — from 20 November to 20 December — a name: Epic Retirement Month. And we’re going to do it every year at this time. This is the month when the most people retire across Australia, New Zealand and much of the western world. Not because it’s a clever tax move, but because the seasons of life just line up that way. So this year we’re bringing a full month of organised, practical, genuinely helpful education.

And, just as I was finishing this newsletter, my first column went live in The Times in the UK: “The secrets of the happiest pensioners.” I’m their new retirement columnist, and it ran as a full Saturday feature. If you have a read, let me know if it resonates — and please send through any ideas or questions you’d love me to tackle in future columns. Retirement education travels well.

Lastly, I’ve been releasing regular reels on Facebook, which is a whole new type of content for me, and I’m having a lot of fun working out the right formats and ideas. You can follow along at facebook.com/becwilsonepic or on Instagram at instagram.com/epicretirement.

Have a lovely Sunday. Now, get out there and make your week epic.

Bec x

Author, columnist, retirement educator, and guest speaker

How to Have an Epic Retirement: Your ultimate guide to living well, loving life and retiring with financial confidence

If you’ve ever wondered what your own epic retirement could look like, this book is for you. How to Have an Epic Retirement guides readers through the way the systems of retirement work, so you can learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

I’d love it if you pre-ordered - it makes a huge difference when retailers can see early demand for the book - they then get actively behind it.

🔷 Order it on Amazon here. 🔷 The book is a hardcover only in the UK so please don’t order the paperback - (the paperback is linking to the aussie/nz export version).

We’re done with our jobs (former careers), but we’ve never “retired” 😎🌴🌵