Retirement conversations to have over Christmas

And, this weekend in The Times: 'The top six retirement regrets — and how to avoid them'

The countdown is on. Christmas is well and truly coming, and tucked in between the fruit mince pies, the long chilly walks and Boxing Day leftovers is something we rarely make space for: time. Time to slow down and talk about life in a way most of us simply can’t during the year. And if you’re somewhere in your fifties or sixties, this is also one of the best opportunities you’ll get to talk about retirement. Not the formal version with paperwork and projections, but the real version that begins with honest conversations about how you want to live.

Before anyone gets carried away thinking retirement planning starts with pensions and spreadsheets and guidance, it’s worth saying plainly that it doesn’t. It starts with conversations. Often about life first, then money. Christmas is one of the few times when couples and families are relaxed enough to lift their heads above the day-to-day and talk honestly about what the future might look like. These early conversations shape everything that follows and help protect you from drifting into decisions that don’t actually fit the life you want.

The most useful way to approach these conversations is to let them unfold naturally, rather than tackling everything at once.

Start with yourself. Christmas gives you rare mental space to ask what you actually want from the next decade or two. What do you want more of, and what are you ready to let go of? How do you want your time, health, work and relationships to feel? Without this internal clarity, financial decisions tend to sit on shaky ground.

From there, talk with your partner about timing and lifestyle. Do you imagine retiring together or at different stages? What do ordinary weeks look like once work loosens its grip? What does a good Tuesday look like? Being able to picture everyday life matters far more than talking about one-off adventures.

Next, widen the lens to your family. Christmas often puts both ageing parents and adult children into sharper focus. You may notice subtle changes in your parents’ confidence or health, while also seeing your children step into independence, housing costs or financial pressure. These shifts don’t need dramatic conversations over the table, but they do influence your own plans more than people expect.

Only then does it make sense to talk about work and money. With some distance from your inbox, it’s easier to ask what role work still plays. Do you want to taper, change direction, work part-time or build a more flexible mix of income and interests? Retirement rarely needs to be all-or-nothing.

Before diving into pensions, it also helps to talk about home. Does where you live still suit the life you want to lead? Is it the right size, location and level of upkeep for the years ahead? You don’t need answers now, but you do need the conversation.

Once life is clearer, the money becomes far easier to deal with. You can look at spending, pensions, investments and timing with a sense of purpose rather than anxiety. Retirement planning doesn’t start with numbers. It ends with them.

And finally, ask yourself one powerful question: ‘what would you do with your days if pay wasn’t the main reason to work?’ If the answer isn’t obvious, that’s not a problem. It just becomes your project for the year ahead.

None of these conversations need to be perfect. They just need space to begin. Christmas often gives you that space. Good luck - consider it a grand adventure.

The top six retirement regrets — and how to avoid them

Plenty of people have told me what they should have done differently before giving up work. Here’s what I’ve learnt.

Imagine that you are retired and looking back on the choices you made in your forties, fifties and sixties. What would you wish you had done differently? It is an uncomfortable question, but a useful one. It forces you to look not only at your financial decisions, but at the shape of the life you’re building.

In my retirement education work and online community I hear a lot of stories from people who have already crossed the threshold into retirement. And I’ve been looking more closely at the regrets they carry and what those regrets tell us about what we can do differently.

These are not the predictable lines about “saving a bit earlier”. They point to something bigger. People are trying to build a life that works in a world where retirement is longer, less certain and far more dependent on personal decisions than it was for the generation before.

This article is published in The Times print edition on Saturday; and featured in digital on Tuesday December 9th. You can read it here.

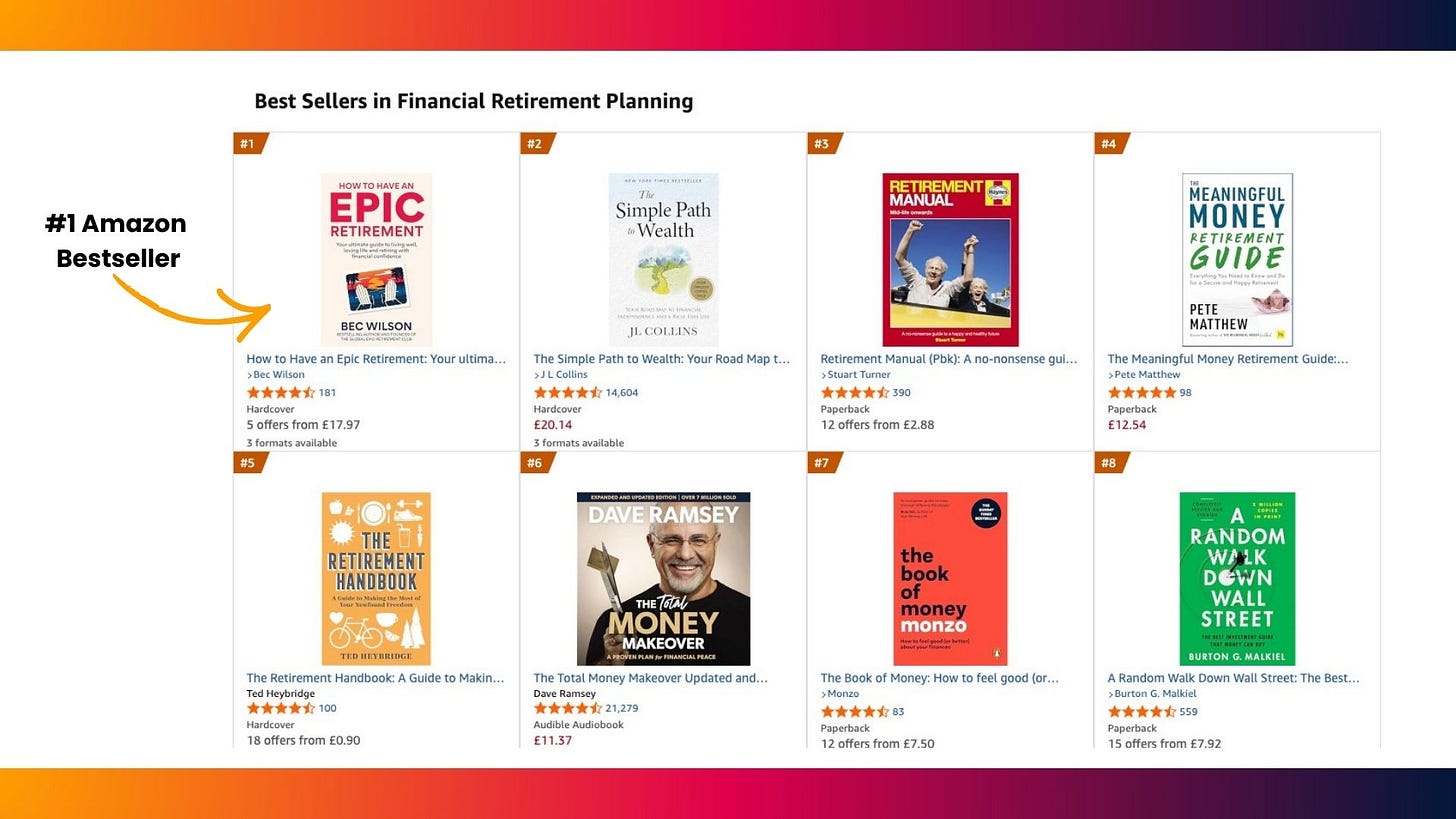

New UK Edition of Epic Retirement is now #1 on the Amazon ‘Financial Retirement Planning’ Bestseller List

Get your copy of the new UK Bestselling pre-retirement guidebook, How to Have an Epic Retirement: Your ultimate guide to living well, loving life and retiring with financial confidence.

How to Have an Epic Retirement is a practical, straight-talking guide for people in their 50s and 60s who want clarity about what comes next — without jargon, fear-mongering or hard sells.

Written for the UK system, it explains how retirement actually works today, from the State Pension and workplace pensions to drawdown, tax and spending. But it goes further than the numbers. It helps you think clearly about work, purpose, health, relationships and how to shape a life that still feels full once work steps back.

From Bec’s Desk

It’s such a buzz to share the news with you about the UK book. It genuinely feels like a shared win, and I’m so grateful to everyone who preordered or placed an order in week one. Thank you for being part of it.

With the book now launched, I can finally see the end of the runway into Christmas. I hope you’re starting to feel that shift too.

After the holidays, I’ll be joining you in the UK for the first month of 2026. If there are companies or community groups you think I should speak to, events to be part of, or radio spots worth chasing, I’d love to hear from you. My goal in life is to provide retirement education you can trust. You know I’m always happy to talk retirement. Just reply to this newsletter and I’ll get it.

Now go and enjoy your Sunday. No doubt there’s shopping to finish and family preparations underway.

Until next week… make it epic!