A real treat - an extract from the UK edition of How to Have an Epic Retirement

This comes from Part Two of the Money section, where we get into the good stuff: working out what you actually need to live well in retirement across the UK.

Today I’ve got a little treat for you — a short extract from How to Have an Epic Retirement – the UK Edition. This comes from Part Two of the Money section, where we get into the good stuff: working out what you actually need to live well in retirement.

The book is now available for pre-order on Amazon and through bookstores, with full release across all UK booksellers on Thursday 11 December. If your local bookshop or Waterstones hasn’t stocked it yet, a quick request will see it arrive within days.

And if you’re thinking of buying it early, a pre-order genuinely helps get the book noticed – so thank you if you choose to place one today.

I hope you enjoy it and it inspires you to seek out a more epic retirement too!

From the back-cover:

How to have an Epic Retirement - Your ultimate guide to living well, loving life and retiring with financial confidence is the ultimate guidebook for modern retirement. Inside you’ll discover:

How to master the six pillars of a fulfilling retirement: time, money, health, happiness, travel and home

Practical advice tailored to British systems - from pensions and the NHS to travel tips and property choices

Real life stories and answers to the questions most retirees wish they’d asked sooner

Whether you’re planning your exit from the 9-to-5 or already enjoying freedom, this guide will help you make the most of your epic years - with confidence, clarity and a touch of flair.

Part 2 - Money

Get a sense of what people really need to retire comfortably

Now that you’ve seen how the UK retirement system fits together, and how your income might come from a few different places, it’s time to talk about what really matters: How much do you actually need to live well in retirement?

It’s a deeply personal question and everyone will have different answers, but that doesn’t mean we should avoid it. By looking at some useful benchmarks for what comfortable looks like, you can start to picture and shape your own version of retirement with a bit more clarity.

YOU DON’T NEED A MILLION POUNDS TO RETIRE IN COMFORT

Let’s get this out of the way early: you don’t need a million-pound pension to have a good retirement. Seriously. It’s time to shift the mindset from ‘How big does my pot need to be?’ to something far more useful: ‘What kind of life do I want, and how much will it cost?’

We’ve already broken down the UK retirement system and the four main sources of income most people draw from:

The State Pension.

Workplace and personal pensions.

Savings and investments outside pensions.

Possibly your home, if you choose to access its value later.

When we look over all these things, we can start thinking practically about what those layers might add up to, and what kind of lifestyle they’ll support.

The first step in working that out is understanding what you’re likely to get from the State Pension, and when. Around 97 per cent of retirees receive it, so it’s the foundation most people build the rest of their retirement income around. Everything else gets layered on top.

It can feel a bit overwhelming when you first start digging into all the moving parts. But don’t panic! If you understand how the State Pension works, you’ve already ticked off one of the biggest pieces of the puzzle. That income layer gives you a base you can count on, and you’ll build the rest using your workplace and personal pensions, savings, and other investments to top it up, smooth it out, and bring your lifestyle to life.

So how much more will you need – on top of that base – to live the kind of retirement you really want?

We’ll get to building a proper budget and looking at your real spending habits in the next section. But before we do that, it’s worth getting your head around some public retirement benchmarks – those official numbers used by planners, policymakers and researchers to help people set realistic retirement income goals.

There are two key benchmarks I want you to understand:

Target Replacement Rates

Pensions UK Retirement Living Standards.

TARGET REPLACEMENT RATES

One of the most useful planning tools in retirement is something called a target replacement rate. It’s a fancy term for a simple idea: calculating the percentage of your working income you’ll need to replace once you stop working.

You might have heard rules like ‘you’ll need 70 per cent of your pre-retirement income in retirement.’ That’s a target replacement rate. But let’s break it down with a UK lens.

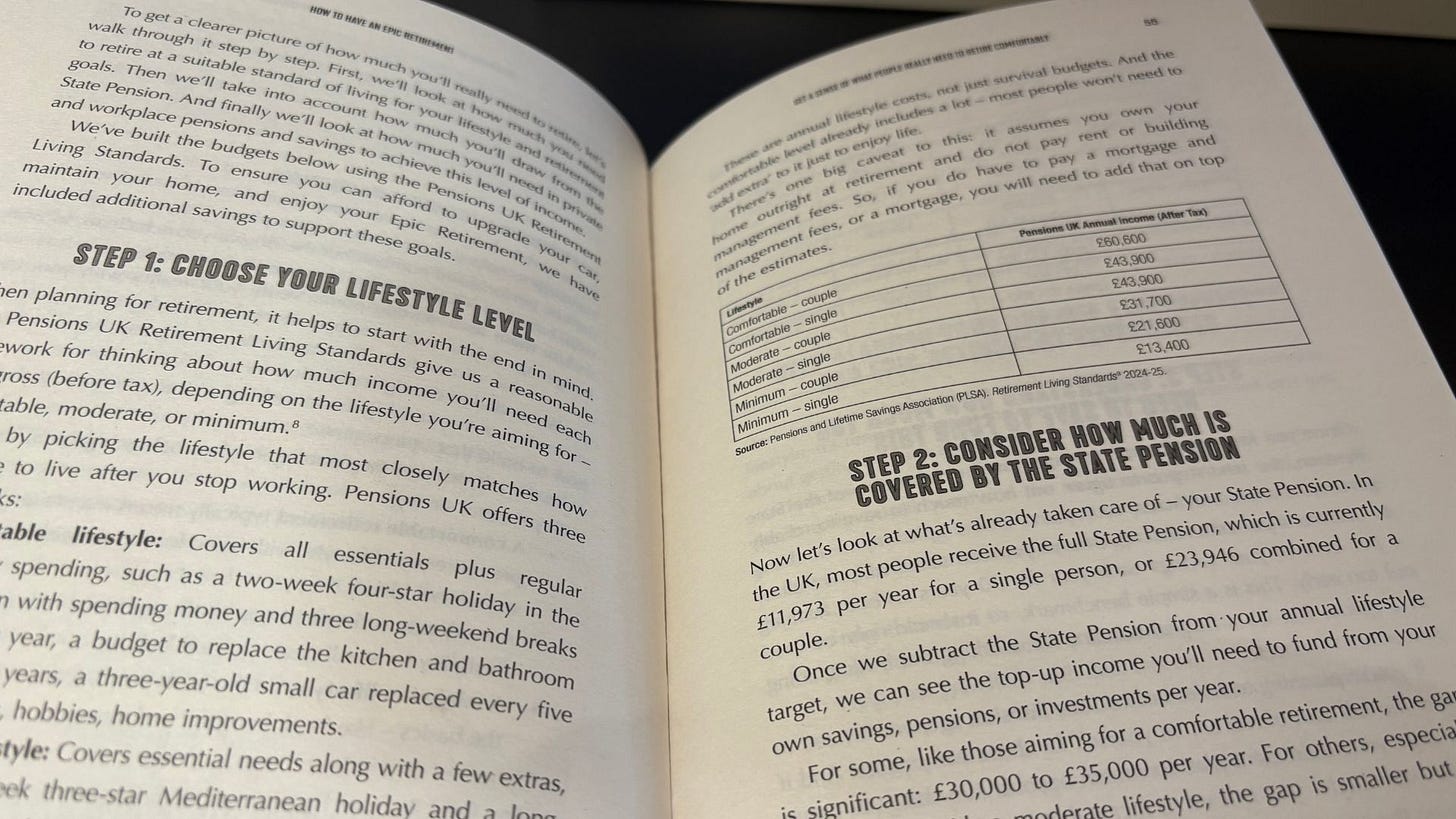

Pensions UK has published detailed benchmarks based on lifestyle types, which we’ll go deeper into shortly, covering minimum, moderate and comfortable retirement standards. These don’t use income percentages, but they do give us a clue. A couple aiming for a moderate retirement needs around £43,900 a year in 2025 prices. That’s roughly 60 to 70 per cent of average household earnings.

Meanwhile, the OECD suggests that an average replacement rate for UK retirees sits around 58 per cent, though this varies widely depending on income and pension type. Lower earners might need a higher replacement rate (up to 80–90 per cent) to maintain their standard of living, because they spend most of what they earn. Higher earners often get by with a lower percentage because more of their income went into saving or luxuries.

Why does this matter?

If you earned £50,000 a year, a 70 per cent replacement rate would suggest aiming for an income of £35,000 a year in retirement. This helps you reverse-engineer your savings goal, working out how much you’ll need to generate that level of income across the decades.

But replacement rates aren’t a rulebook – they’re a guide. Your actual number depends on:

Your mortgage or rent situation.

How much you want to travel or support family.

Whether you’ll continue working part-time.

Your health, location, and lifestyle.

Use it as a starting point, not a finish line.

THE PENSIONS UK RETIREMENT LIVING STANDARDS

Pensions UK has developed some clear, lifestyle-based retirement standards to help you sense-check your plans. They won’t give you a perfect, personalised number, but they’ll give you a ballpark to work with, based on what everyday life costs in retirement.

Use them as a starting point. Verify your reality with your own budgeting. Adjust your numbers for your lifestyle, your goals, and your version of comfort. The standards are a great way to check if you’re headed in the right direction.

And if you’re planning for something a bit more epic, I’ll show you how to build that in too.

In the UK, retirement planning involves balancing the State Pension with personal savings.

A comfortable retirement typically means maintaining your pre-retirement lifestyle, with room for travel, hobbies, and the occasional luxury.

A moderate retirement covers all essentials, with some flexibility for small treats or a UK holiday.

A minimum lifestyle, on the other hand, focuses purely on the basics – like food, housing, and transport – and is largely reliant on the State Pension alone.

The full UK State Pension in 2025/26 provides £11,973 per person annually. Couples relying solely on the State Pension receive around £23,952 (double the State Pension rate for individuals).

However, to enjoy a more comfortable retirement with room for discretionary spending on travel, hobbies, and other lifestyle choices, additional savings are generally needed.

To get a clearer picture of how much you’ll really need to retire, let’s walk through it step by step. First, we’ll look at how much you need to retire at a suitable standard of living for your lifestyle and retirement goals. Then we’ll take into account how much you’ll draw from the State Pension. And finally we’ll look at how much you’ll need in private and workplace pensions and savings to achieve this level of income.

We’ve built the budgets below (in the book) using the Pensions UK Retirement Living Standards. To ensure you can afford to upgrade your car, maintain your home, and enjoy your Epic Retirement, we have included additional savings to support these goals.

CALCULATING A REPLACEMENT RATE FOR THE AVERAGE BRIT

The median UK household disposable income (after tax and benefits) was £36,700 in 2023/24, according to the Office of National Statistics.

If you’re aiming for a 70 per cent replacement rate in retirement, a common benchmark used by planners, you’d be targeting around £25,690 a year in retirement income.

This isn’t a hard rule, but it gives you a realistic baseline. Your actual number might be higher or lower depending on your lifestyle, spending habits, and housing costs in retirement.

Think of this as a way to sanity-check your savings goals. Are you on track to replace the income you’ll actually need?

Order your copy of How to Have an Epic Retirement now. It hits bookstores this week on 11 December, and if you’d like one under your tree, you’ll want to order soon — before the mail services wind down for the break.

(Note - do not order the paperback edition - that links through to the AU/NZ edition as there is no paperback edition of the UK book.)